At some point, the complexity of trying to administer a firm with too many goods and services will offset any cost savings, particularly if the goods and services share little in terms of production resources or processes. However, sometimes firms discover power of attorney scope economies that are not so obvious and can realize increased economic profits, at least for a time until the competition copies their discovery. This process only takes the total joint cost and divide the total quantity of all products type.

Reverse cost method 🔗

Co-products are the secondary product that results alongside the main product. An increase in one product’s output will increase the quantity of the other products, or vice versa, but not necessarily in the same proportion. Management may have decided, however, that it is more profitable to process certain products further before they are sold.

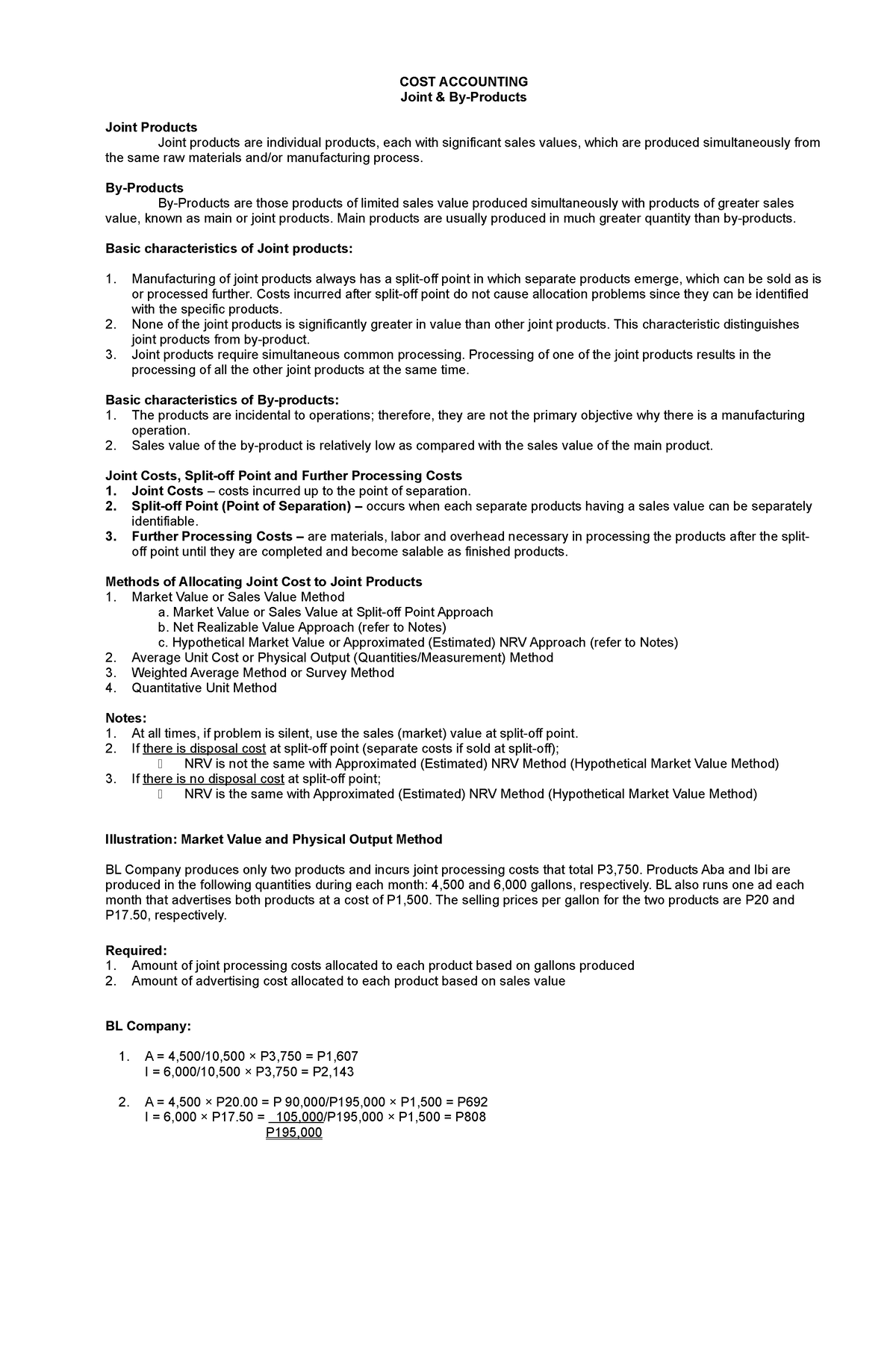

Joint products, by-products and joint costs

The chosen method depends on the nature of the products and the information available to the company. Allocating joint costs is an important aspect of cost accounting for companies that produce joint products. Joint costs are the costs incurred in the production of joint products, such as the cost of raw materials and direct labor. Cost accountants must choose an allocation method that accurately reflects the resources used and the value of the products produced.

Get Any Financial Question Answered

In summary, cost accountants must ensure that joint and by-product costing complies with regulatory requirements, including tax regulations and accounting standards. For example, if the wood chips have a value of $20 per batch, and 10% of the logs are turned into wood chips, then the cost accountant would allocate $2 of the total joint costs to the wood chips. When deciding on the most effective way to allocate costs, joint and by-product costing are two popular methods. Joint costing is used when two or more products are produced from a common process, and the costs must be divided between the products.

Regulatory Compliance- concept in detail with a comprehensive example

It may be defined as the cost incurred to produce two or more different products by processing one or more raw materials through a common production process or a series of production processes. Another method for allocating joint costs is the sales value at the split-off method. Under this method, joint costs are allocated based on the sales value of each joint product at the point where they are separated from each other in the production process. Any outputs having insignificant economic value and which are not primarily intended to be manufactured are called by-products. This differentiation is needed because of difference in accounting between by-products and joint products.

Relationship Between Actual Costs & FP&A in Manufacturing

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. If the products obtained are of different significant values, the product with the greater value is the main product and the product with the less value is a by-product/secondary product. Legal advice requires an in-depth understanding of your specific circumstances and tailored guidance to address the nuances of your situation. This post provides general information on the Final Rule but does not consider individual complexities or industry-specific challenges you may face.

- By Products and Scrap SalesThe net realizable value of by-products or scrap that is normally sold is subtracted from total joint costs before allocating joint costs to joint products.

- Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

- Separating by-product costs is important for accurately determining the cost of production for the main product and for the by-product.

- The chosen method depends on the nature of the products and the information available to the company.

The physical units method is usually applied to the joint products which are similar in state and have a standard unit of measurement. In this method, the apportionment of the joint cost is done through relative quantity or weight of the joint products, at the split-off-point. For example, a paper company produces paper pulp as the main product and wood chips as a by-product. The cost accountant uses the sales value at the split-off method to allocate joint costs between paper pulp and wood chips. Cost accountants must consistently use the same allocation method to ensure comparable financial statements. It may be difficult to compare the financial statements if different allocation methods are used for joint and by-product costs from year to year.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

When we undergo the apportionment of joint cost for accounting purpose, we will see that there are different methods available for determining it. This method accurately reflects the relative value of the resources used in the production of each product and is consistent with accounting principles. One type of cost savings is the ability to share fixed costs across the product and service lines so that the total fixed costs are less than if the operations were organized separately. For example, suppose we have a company that expands from selling one product to two similar products.