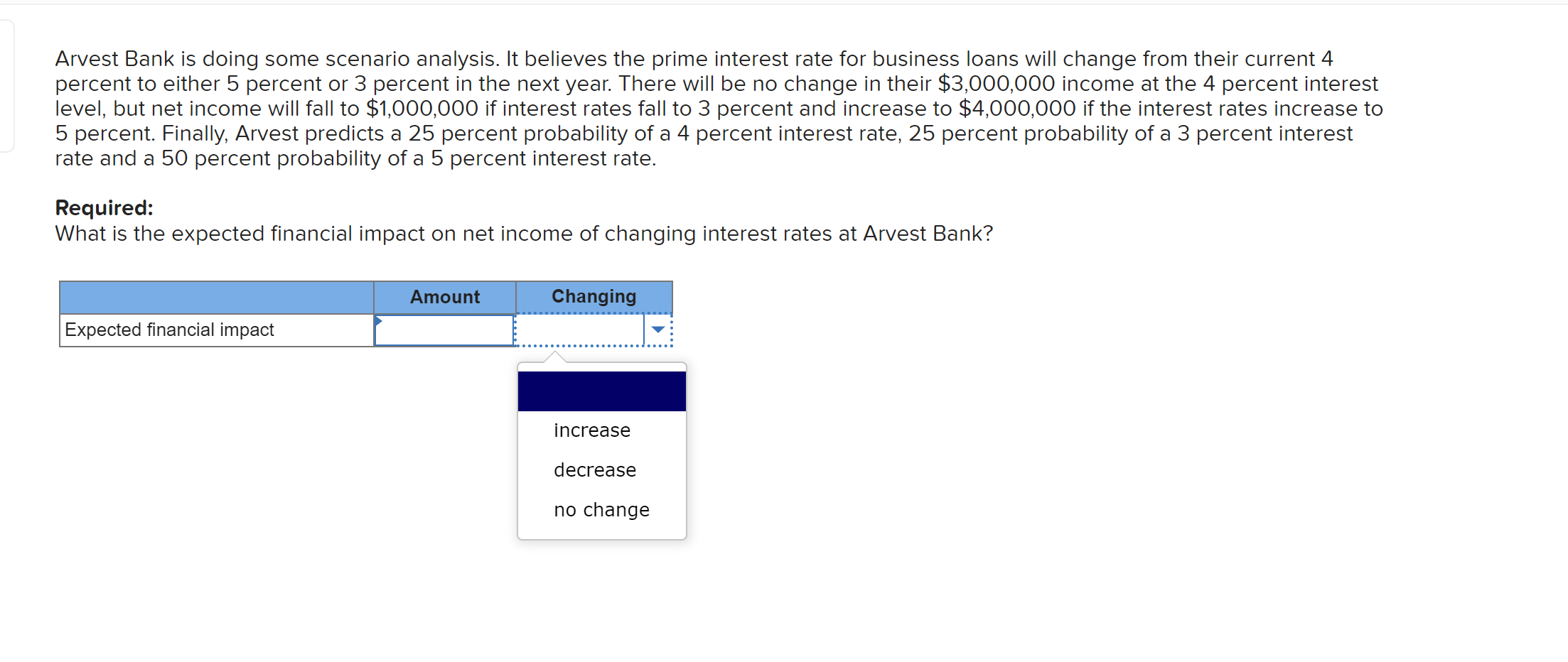

For new homeowners, closing costs will likely be an urgent added cost when you have currently longer to really make the downpayment or any other closing expenditures. A zero-closing-cost mortgage provides the opportunity to move the mortgage settlement costs to your amount borrowed. Before going in the future which have a zero-closing-costs mortgage, weighing the advantages and disadvantages towards intricate opinion lower than.

- Insights Zero-Closing-Costs Mortgages

- How come a no-Closing-Prices Home loan Functions?

- What’s the Difference between a zero-Closing-Cost Home loan and you may a classic Home loan?

- Select Most of the fourteen Things

A no-closing-costs mortgage are a mortgage loan where debtor do not have to afford the typical closing costs of acquiring that loan. New closing costs aren’t waived; alternatively, you will have the chance to outlay cash through the years as a key part of month-to-month home loan repayments.

Suppose you’re taking that loan off $3 hundred,000. You will definitely pay ranging from $9,000 and you will $18,000 in conclusion will cost you. The financial institution need to inform you prior to closing how much cash you could potentially expect to pay to online personal loans KS summarize will cost you. Towards the top of almost every other expenses before closure, home loan settlement costs would be a lot of for almost all homeowners, particularly earliest-go out people.

Lenders promote a no-closing-costs home loan instead of assist residents purchase a property having fewer upfront costs. Using this type of home loan choice, you don’t need to afford the closing costs initial when selecting another type of home.

With a no-closing-costs financial, the 3% to 6% settlement costs is folded to your loan harmony otherwise compensated to possess thanks to a high rate of interest. This is the main drawback from a no-closing-rates mortgage: Could result in expenses furthermore the life span of the home loan. But you’ll shell out faster upfront, potentially letting you move into your home at some point.

Antique mortgages certainly are the most frequent particular home loan. Financial institutions, on the web loan providers and borrowing from the bank unions bring traditional mortgages. These businesses wanted consumers to pay for closing costs at the latest selling of the house. Closing costs become identity insurance, attorney charge, appraisals, taxes and. Oftentimes, this will likewise incorporate checks, when you must pay money for checks out-of-pocket.

The difference between a no-closing-cost home loan and you may a traditional financial occurs when you have to purchase those people expenditures. In , an average financial on the U.S. try $460,000. Settlement costs to the a loan one dimensions you certainly will consist of $thirteen,800 to help you $27,600. If you possess the coupons to pay you to definitely number initial, you’ll always save yourself far more for the interest by using a timeless home loan to pay settlement costs.

If you don’t have additional discounts or have used all of your current cash reserves getting a much bigger down-payment, a zero-closing-pricing mortgage can be advisable. You can shell out a top interest otherwise most fees to make up for you to definitely convenience

We can’t all qualify for a no-closing-rates financial whilst means certain fico scores or financial circumstances. Basically, you will need a high credit history and have indicated economic balances thanks to a lot of time-title a career, all the way down debt otherwise deals supplies. The particular conditions are very different by lender.

For most homeowners, discover high advantageous assets to a zero-closing-costs mortgage. Listed here is why should you consider this sorts of mortgage.

Lower Initial Cost

A no-closing-rates mortgage eliminates have to pay certain charges, particularly software charge, appraisal charges and you will label costs, which can slow down the very first economic load towards debtor. This can indicate you are able to pick a home fundamentally, with all the way down complete upfront can cost you.

Improved Earnings

By avoiding initial closing costs, borrowers may have more income open to spend some towards the most other important costs otherwise capital options. You are able to the money coupons to possess fixes otherwise renovations on the the property or even remain more substantial disaster funds, healing certain financial pressures.

Basic Budgeting

And no-closing-prices mortgage loans, consumers has a clearer understanding of the immediate bills once the they don’t have to spend some fund for closing costs. You will understand how much you pay into the mortgage per month and come up with budgeting and you will economic planning convenient.

When you are zero-closing-rates mortgages offer comfort, you’ll pay money for one to convenience when you look at the higher a lot of time-label will cost you. Here are the downsides of this kind regarding home loan.

Highest Rates

Lenders tend to compensate for new waived settlement costs of the recharging borrowers a somewhat highest interest, ultimately causing large monthly obligations and you can increased a lot of time-title credit can cost you.

Based interest levels, certain financial amortization calculators advise that possible shell out to 3 minutes as frequently to summarize will cost you along the loan’s lifetime compared so you’re able to expenses these costs upfront. That means that $twelve,000 in closing costs can be more than just $33,000 reduced over the years.

Minimal Choice

Not absolutely all loan providers provide no-closing-rates mortgages, that can limit the choices available so you can consumers. This may potentially limit you against picking out the really favorable mortgage conditions or lower rates. If you are looking to discover the best readily available financial words, a no-closing-rates mortgage often is not necessarily the best option.

Faster Collateral

From the financing the latest settlement costs, individuals could see its guarantee disappear, which can effect coming refinancing otherwise household equity financing alternatives. Should your goal is always to build security in the home given that quickly as you are able to, a zero-closing-cost mortgage always isn’t the best bet.

The huge benefits and you may downsides from no-closing-prices mortgage loans get smaller so you can enough time-label and you can brief-title cashflow. In the event the a zero-closing-costs financial setting you can purchase your dream assets now, it could be a pretty wise solution. But when you have the money reserves to blow the latest closure will cost you initial, it can save you far more future, releasing up a lot more dollars getting senior years savings otherwise investment. You will have the option to utilize way more loan providers. To begin with researching options, get the best mortgage lenders right here.