Established Mortgage Terms and conditions: Buyers can get inherit people established issues otherwise cons for the original financial, like prepayment charges otherwise bad terms.

Frequently asked questions on the Assumable Mortgage loans

Inquiring on the assumable mortgage loans tend to brings forth multiple issues. Buyers and you can providers equivalent look for clarity into the workings out of assumable mortgages, the qualification standards, and prospective benefitsmon inquiries rotate inside the means of and if a great mortgage, understanding the ins and outs out-of home loan assumable words, and you can if or not certain funds, particularly assumable speed mortgages, are beneficial in the modern market. Ways to these Faqs shed light on new feasibility off opting for assumable resource, the latest tips in it, and also the potential disadvantages. Ergo, a thorough comprehension of assumable mortgage loans is crucial to own advised decision-while making inside a property transactions.

These could tend to be expectation costs, settlement costs, and possible adjustments getting rates otherwise a fantastic balances. Facts this type of expenditures is very important for those considering while home financing, making sure informed choice-to make into the home deals.

How exactly to Qualify for A keen Assumable Home loan

Prospective customers need see financial criteria, and additionally creditworthiness, income balances, and you may probably a down payment. Knowledge such certificates is paramount of these seeking assumable financing, guiding them from the app procedure and you may broadening its possibility of protecting the necessary home mortgage.

Try an enthusiastic Assumable Mortgage An effective?

When you’re assumable mortgages promote benefits such as for instance good rates and you can reduced closing costs, they may come that have limits including stringent recognition process and you will inheriting existing mortgage words. Assessing personal monetary goals and you can sector criteria is very important within the determining if an enthusiastic assumable home loan aligns that have a person’s demands, ensuring a proper-advised choice from inside the a residential property ventures.

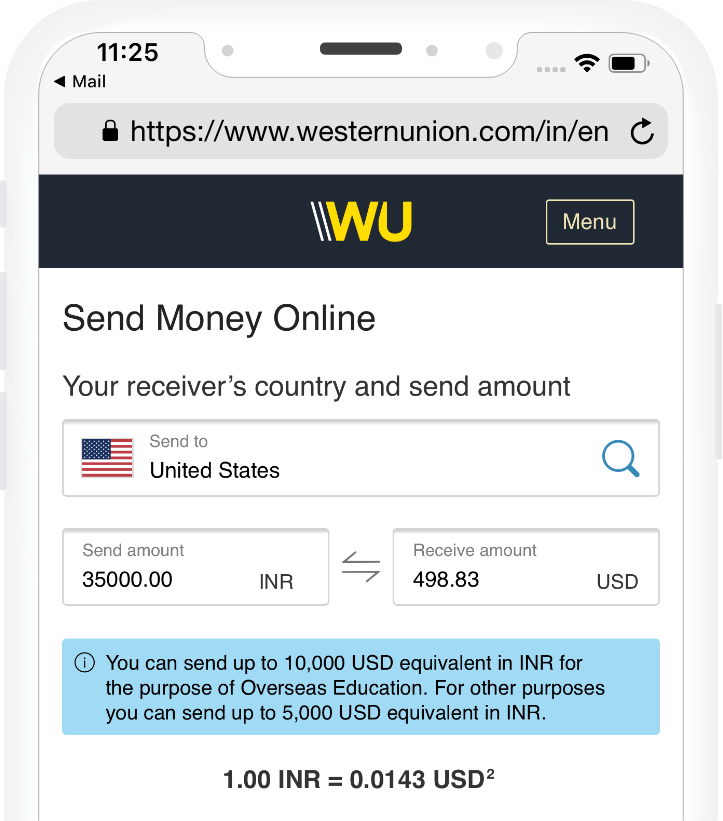

Because mortgage pricing was more than six%, overtaking someone else’s down-rate financing should be a terrific way to reduce attract.

Assumable mortgage loans may be the mechanism enabling you to definitely do that: After you assume a home loan, you’re essentially picking up the earlier owner’s mortgage, with the exact same interest rate and you will terms, once you pick their home.

It’s a pretty uncommon disperse, inside the large part as not all type of mortgages meet the criteria getting expectation. And additionally, it usually requires that the consumer assembled a lot of money during purchase to cover the number of security the seller possess home.

Home loan expectation would be tricky and has the disadvantages, nevertheless possible prize – a diminished rate of interest – helps it be worthwhile.

Why does an assumable financial really works?

Homebuyers have a tendency to thought if in case mortgages whenever interest rates regarding the market is higher than they were during a recent several months. Those individuals are definitely the right housing market standards the audience is inside now, that has brought about a surge interesting during the assumable mortgages. Based on American Banker, the quantity off presumptions grew by the 67% ranging from 2022 and 2023.

Despite you to definitely increases, it’s still a niche tool, once the authorities-backed financing are usually the only mortgages eligible to getting thought. Fannie mae and Freddie Mac computer financing – almost two-thirds of your own financial market – are often ineligible.

Area of the mark off an enthusiastic assumable loan ‘s the power to safer a reduced price than simply you would score with a brand new home loan, resulted in extreme offers original site.

But assumable mortgage loans aren’t an option for many customers due to the need for a big bucks commission for the supplier. (Consumers usually have to blow owner the essential difference between the latest financial harmony while the business cost of our home.) Other factors which can create a beneficial nonstarter are a longer timeline to shut, low numbers of government-recognized mortgages in some locations and the difficulties out-of distinguishing all of them.