Double-choose and you will erase people away-of-day beneficiaries on the company-sponsored term life insurance and you may 401(k) package, particularly if you was solitary once you become your job. “Just in case there can be a primary lifetime transform, you will want to have a look at men and women recipient comments,” claims Dee Lee, an official financial coordinator having Harvard Financial Coaches. Your mother and father, siblings, otherwise a previous spouse might still feel noted in lieu of your youngster.

3rd Day

It few days, you need to check your credit rating and make use of all of that expenses suggestions you have been event to help make a formal funds.

Check out your own credit.

Save time and disappointment from the correcting problems now, if your every day life is relatively sane. Having a strong credit rating is very important if you’re a dad-to-end up being and you may probably exploring huge purchases such as for instance property or an auto in the near future. With a leading credit history makes it possible to secure this new best interest price into a car loan or financial.

You can to purchase your credit report regarding Equifax, Experian, or Transunion. Legally, they might charge only about $several to possess a standard report. Be forewarned one to applying for a no cost credit check off smaller credible providers would be an invitation in order to identity theft & fraud. On top of that, maximum yourself to one view annually-any more than that may harm your rating.

Crisis this new numbers.

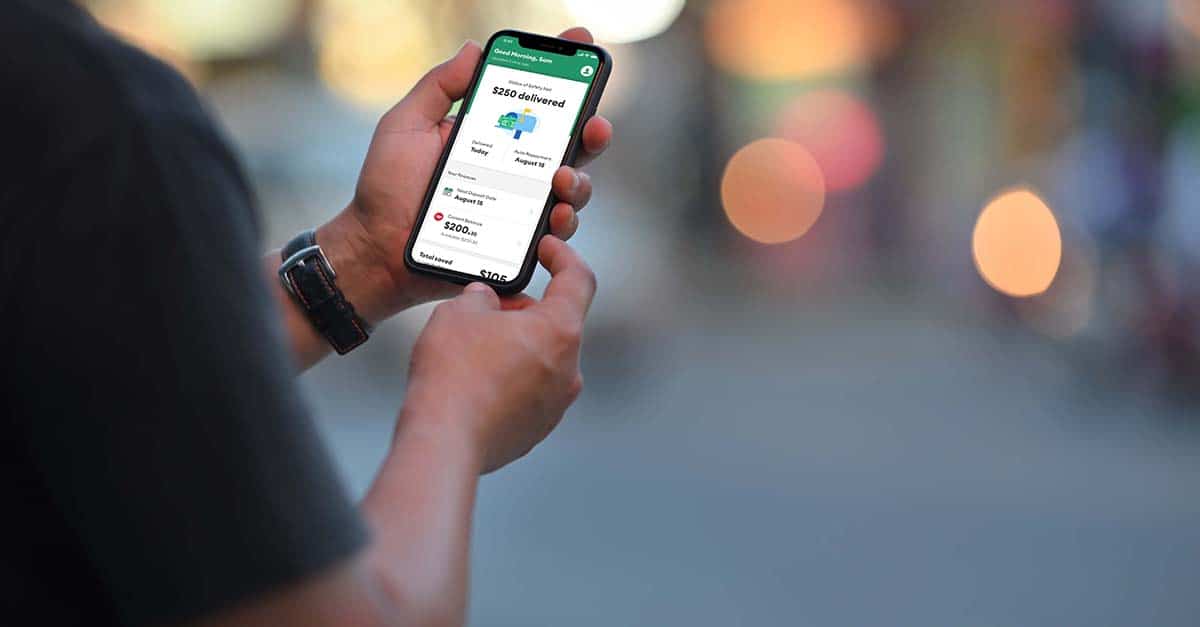

Now it’s time to acquire down seriously to the final action away from budget-and also make. Take-all the brand new quantity on expenses you have monitored this new prior several months and put them within the a spreadsheet or funds record software (for folks who have not already). This can make you the full picture of your expenditures-before you can provide them with a facelift to arrange to possess little one.

Your aim is not just to break even, but to save cash regularly, says Stephen Brobeck, administrator movie director of one’s User Federation of The united states (CFA), an advocacy and you may education company from inside the Arizona, D.C. A 2019 survey by the Bankrate learned that one out of four performing Us americans commonly saving hardly any money to own retirement, a crisis fund, and other a lot of time-term economic goals.

When making your brand new budget, recall your next childrearing can cost you. Considering a great 2015 USDA statement (the newest investigation readily available), the typical center-money domiciles should expect to blow regarding $1,056 a month to include a baby that have concepts instance food, attire, security, transportation, and childcare. By using a lengthy get off off work (or change to region-big date era) you can easily face the new monetary twice-whammy out-of covering these the new costs toward a full time income that’s abruptly quicker.

Lovers which cannot apparently save your self its solution to advised 10%-of-your-earnings mark may prefer to guide an appointment having a certified economic planner, a pro trained to assist subscribers set monetary wants. New Monetary Believe Association explains qualification and you will charge with the the web site. The latest CFA offers totally free consultations together with other budget guidance through their America Saves program.

4th Month

It’s time to assess the money out-of exactly how it is possible to buy their baby’s costs after they’re produced, of course, if relevant, how much time you’ll cut off away from work.

Build a friend from inside the Time.

Rating an entire briefing about pregnancy or paternity advantages of individual info. https://cashadvanceamerica.net/200-dollar-payday-loan/ Federal rules demands one to give at the very least thirty day period observe whenever asking for time off within the Family members and you may Medical Exit Act, and therefore entitles one the new mother or father who works well with a buddies with at the least fifty team when planning on taking as much as several months of outstanding, seniority-safe exit.

Your boss need to pay the usual percentage of your own medical care positives to your period. In addition to people paid down give you could have, federal legislation and entitles beginning mothers to small-term handicap spend (usually 5 to 9 days) in the event the the organization ordinarily pays handicap positives various other facts.