Most of us have heard of cues. Timely Cash Today! Rating Cash Zero Borrowing from the bank Called for! a dozen mil Us citizens utilize payday loans and you may vehicles identity money within minimum annually. Listed below are some what you should consider before you join all of them.

Those who sign up for vehicle title funds and you can payday loan is actually constantly searching for quick cash. They move to this type of “alternative financing” for all causes:

1. No credit score assessment required (credit rating chart)2. Easy and quick app process3. Temporary financing (15-forty five months) cuatro. Quick bucks

Songs high, right? Millions of Americans think so. But not, you can find important knowledge to be familiar with in the event it pertains to these types of solution fund.

step 1. Rates

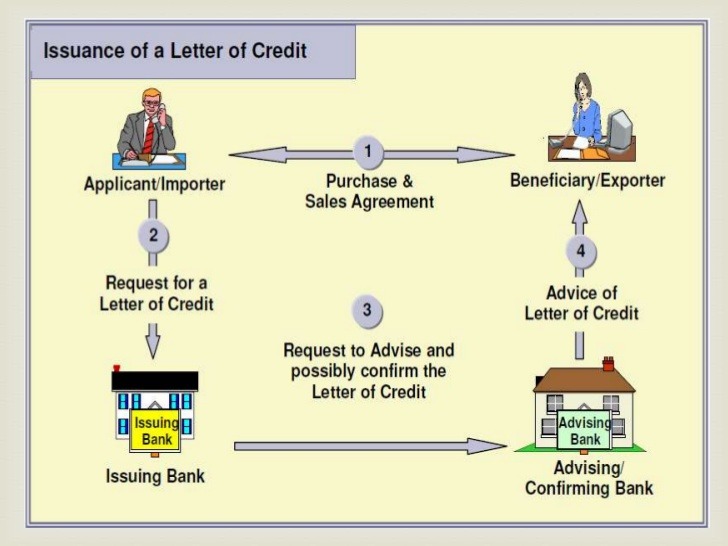

Apr or Annual percentage rate ‘s the cost you pay for every season so you can borrow cash, together with charge, conveyed since the a portion. Whether or not it sounds confusing, to not care and attention.

All you need to discover is the fact that the high the fresh Apr, the more expensive the mortgage. Here is a picture demonstrating very demonstrably new blazing difference between conventional loan rates averages and you can solution loan rates averages. Vehicle name financing prices and you may pay day loan costs are somewhat and scarily high.

dos. Hopeless Debt Duration

For folks who truly only ever before made use of a choice financing immediately after a good seasons, along with to pay the latest absurd fee, perhaps it wouldn’t be the end of the nation. Nevertheless the reality is, when you find yourself pay-day and you can auto identity fund are stated as ideal for an unexpected emergency, 7 out of ten consumers are employing them having regular, recurring costs such as for example rent and you can tools, considering .

Having expenditures that add up to a bigger count as compared to household’s money implies that there’s an ongoing cash flow point and you will that it’s likely an identical state will happen over-and-over. Struggling to create charge card minimal repayments? These mortgage is not the answer. Consider it this way – if someone try lower into the cash and you may becomes a payday/identity financing, what are the chance they are lowest to the cash again next month, otherwise next pay period? Exactly how will they be supposed to shelter their bills And you will shell out right back the borrowed funds featuring its fees?

This new CFPB learned that over 80% regarding payday loans was folded over, or transitioned towards another loan in the place of paid, inside 14 days. The same CFPB report showed that payday individuals renew their loans unnecessary moments they finish investing much more for the charges than simply the total amount it in the first place borrowed. The average pay day loan debtor spends $520 within the charges for what to begin with are a $375 loan. Not surprising $seven million was repaid annually so you can pay day lenders!

And, one in 5 individuals who glance at the car title loan processes find yourself defaulting and you may dropping its vehicle, according to Cymone Bolding, chairwoman of one’s Arizonans for Fair Financing Coalition. In case the vehicles deserves $ten,000 and you pay this new identity to receive an effective $5,000 identity loan amount, what are the possibility that you’ll have that $5000 available willing to repay for the an effective month’s day? It is more inclined which you end up unable to pay-off otherwise you will need to take-out extra loans to blow the original you to definitely.

You to definitely More sensible choice: Generate a relationship with a cards Union (or bank)

Even though we have been partial to borrowing from the bank unions because they eradicate all of the representative once the the same companion of one’s organization, continue fees and pricing lower, and you will value its organizations, actually a bank is better than counting on option loan providers.

So what does they suggest to own a great ‘relationship’ which have a monetary place? It just means you should unlock a merchant account and maintain they inside the an effective updates for a little while. Here’s a few information:

- Keep a confident harmony within the a bank account and you can/otherwise savings account.

- Incorporate $5 otherwise $10 to a checking account each month to demonstrate you could consistently ‘pay on your own.’

- Start to generate credit by using aside a tiny secure loan as much as possible.

- Otherwise, is getting a good cosigner into financing or becoming an authorized associate on the a dependable appreciated one’s account.

You could potentially make your borrowing and your financial profile in once the nothing given that 6-one year. And because borrowing unions merely exists so you can suffice players, we’re eager to help you to get here. You could begin here – by training debt wellness get and ways to boost they.

Once you’ve a good credit score (a lot more than 640ish), you will be capable qualify for a personal type of credit to use for the emergencies. Signature loans, Automotive loans and Mortgages won’t be out of the question possibly. Discover numerous financing sizes you’ll discuss.

Even although you have a bad credit records, i still have a checking account selection for you – the Is actually Once more Examining. You will have to just take an application to review this new activities out-of responsible banking, and need to pay a repair commission, however you will be able to upgrade your Is Once more Savings account in order to a consistent family savings for people who stay in a position getting 12 months.

Completion

Choice financing organizations will in all probability be available to you, in one mode or other, however, that does not mean one twelve billion Us citizens each year you would like as using all of them. When we beginning to bequeath the word for you to start a romance that have a financial otherwise credit commitment, while making they obvious exactly what the possibilities are to cash advance and automobile term financing, perhaps you to definitely count should be reduced.

step 1 This information is meant to be a general money merely which can be maybe not meant to be nor does it make up judge suggestions. One pointers depend on thoughts just. Pricing, terminology, and you can criteria is actually susceptible to transform and may also are very different considering creditworthiness, official certification, and you can collateral standards. Most of the loans subject to approval. Subscription becomes necessary.